We are still positive on real estate

We Are Still Positive on Real Estate

Click Here to Discover our Updated Real Estate Research

Real Estate Prices had fallen by 50% in some U.S. Cities. While homeownership rate has been declining since 2004, and housing affordability is lower due to higher home prices and mortgage rates, we are still optimistic on the U.S. housing market.

With home prices that bottomed out in 2012, home price appreciation has continued at a strong pace (more than 10%) in most top cities. Existing home sales reached the highest level since 2007, while the median price shows nine consecutive months of double-digit year-over-year increases. Chicago’s median sales price increased by 25% according to HousingWire.

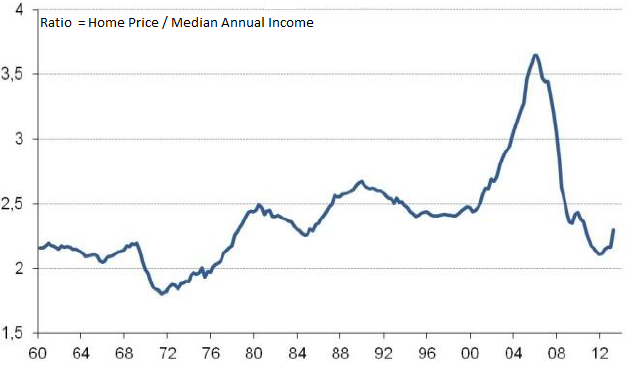

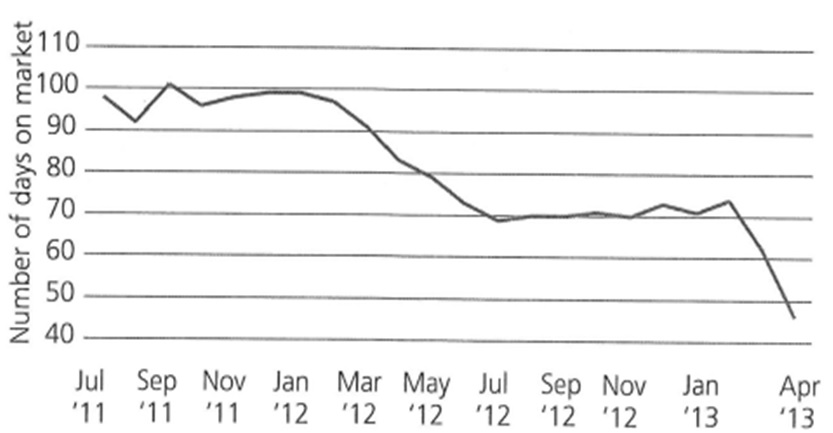

U.S. home prices are back to long-term trends (0% to 2% inflation-adjusted return). Time on the market dropped substantially but prices in some states may already be above trend. San Francisco prices have already increased by close to 40% from their lows!

We are also encouraged by the improving availability of mortgage credit. Furthermore, Goldman Sachs estimates that nearly 60% of existing home sales were all-cash purchases (vs. 20%-30% during 2005-2008).

Finally, the number of new foreclosure fillings hit its lowest level in nearly eight years.

We have a positive view since March 2012. You can find the BFM’s 2012 real estate research at: http://www.bourbonfm.com/resources-tips.

Executive Summary

• Median home prices are up more than 10% after going down 27% between 2007 and 2012.

• The annual increase of the median home price is the highest on record.

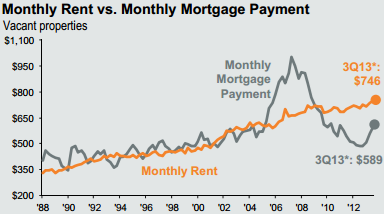

• Buying continues to be cheaper than renting.

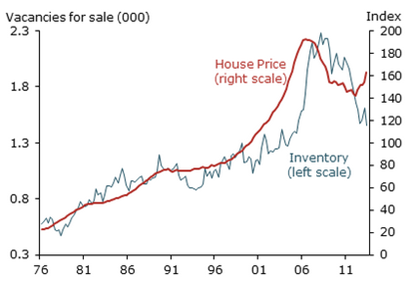

• Home inventories continue to decline.

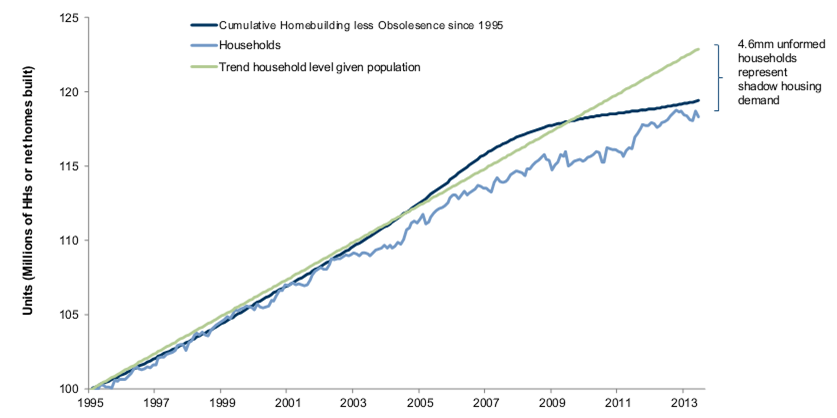

• Good demographics (household formation) should drive new demand.

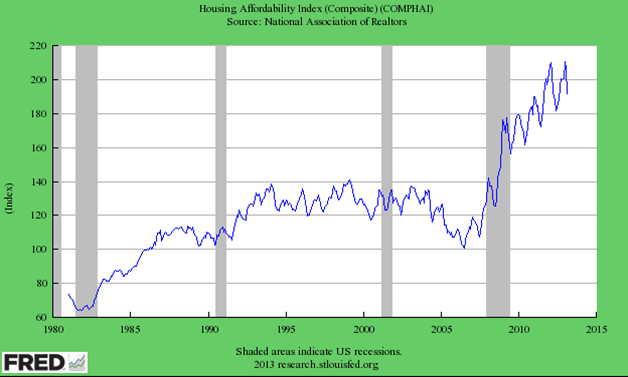

• Housing affordability is still high.

• Prices are still low relative to household income.

• Time on the market dropped.

Click Here to Discover More Charts and Prices by City

Let’s not forget that the real estate market is a very local market. We can help you decide if the price is right thanks to our proprietary real estate valuation model.

Don’t hesitate to contact us!

We hope you will find our research both informative and insightful. We can offer more information depending on your individual needs. We provide customized services (personal Chief Financial Officer) and we may be able to solve a specific problem and help you achieve your goals.

WE BRING YOU FINANCIAL SECURITY.

This newsletter was first published in October in 2013

http://bourbon-fm.com/file/BFM_Newsletter_102013_An_Updated_Positive_Vie...