Investor's performance

Investors Fail to Capture the Returns they Expected

Chasing Performance May Lower your Returns

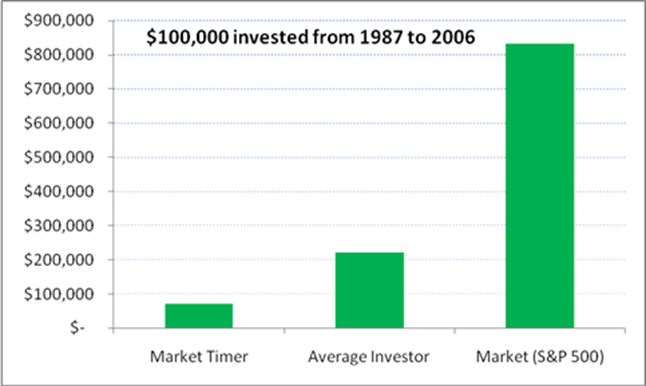

Dalbar Research Institute shows that investor’s performance does not equal investment performance. They found the following annualized returns for investors from 1987 to 2006 (similar results are found for different time period):

-The average equity-fund investor realized an annualized return of 4.30% ($100,000 became $222,536).

-The market timer equity fund investor realized an annualized return of -1.80% ($100,000 became $70,814).

-The market (S&P 500) realized an annualized return of 11.80% ($100,000 became $832,519).

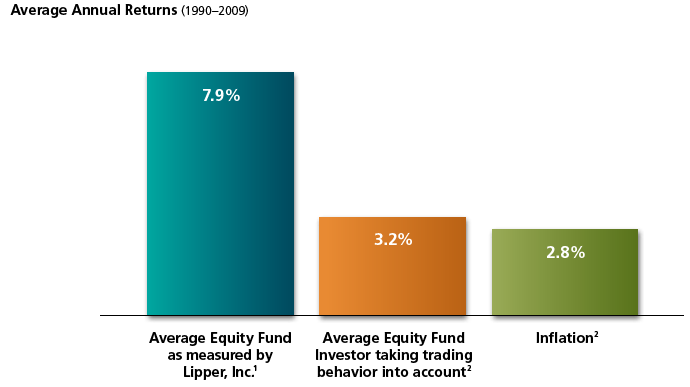

Using another research report from Lipper and DALBAR, we can see, in the chart below, that chasing performance may lower your returns. This research shows how mutual fund investors’ behavior affects the returns they actually earn.

Source: Lipper and DALBAR

PS : BFM was quoted in a magazine! See attached.

AnImage Propertiesother good news is that I am now leveraging my retirement investment expertise into the corporate world…. Since October, I spend half of my time managing the 401k (retirement plans) of 60,000+ individuals, a total of $1.5 billion

This newsletter was first published in November of 2010