Is inflation stealing your future?

Is inflation stealing your future?

At BFM, we help you make better financial decisions so that you can have peace of mind.

Our core beliefs are:

• Asset Allocation is the most important determinant of performance

• A globally diversified portfolio reduces risk

• A disciplined investment process is critical

BFM enables you to increase your wealth through independent financial advice with no conflict of interest. We neither sell products nor receive commissions.

Executive Summary

• As you get closer to retirement, you face an increasing risk of negative real returns, also called inflation-adjusted returns. This erodes your purchasing power and has a negative impact on your wealth.

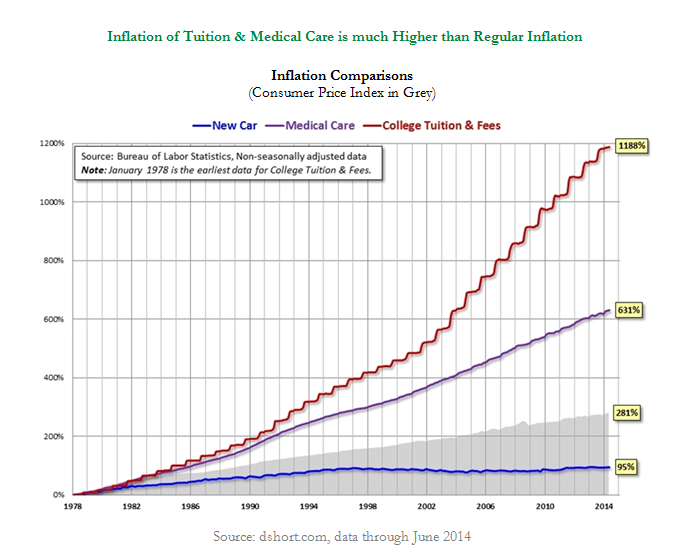

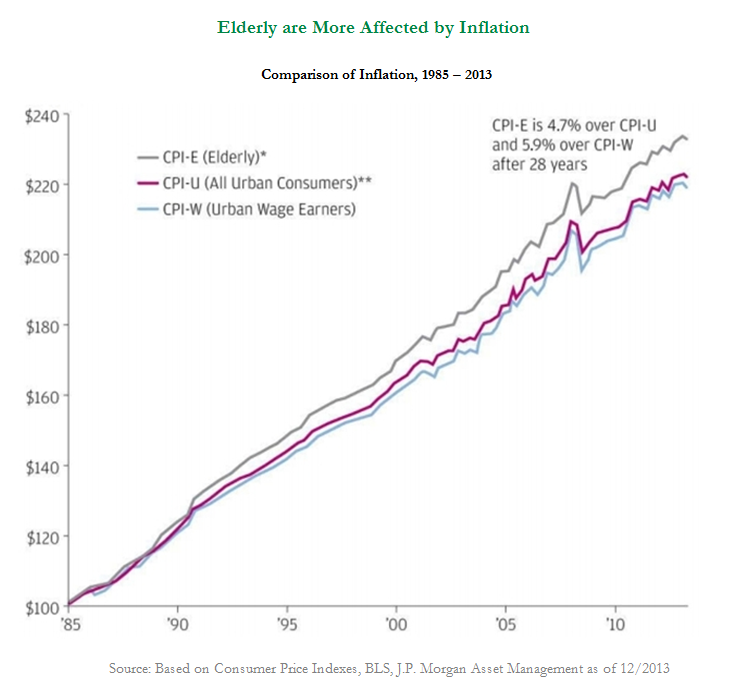

• Inflation (or price increase) is higher for college tuition, medical care, food, and energy.

• True inflation may be higher than officially reported inflation.

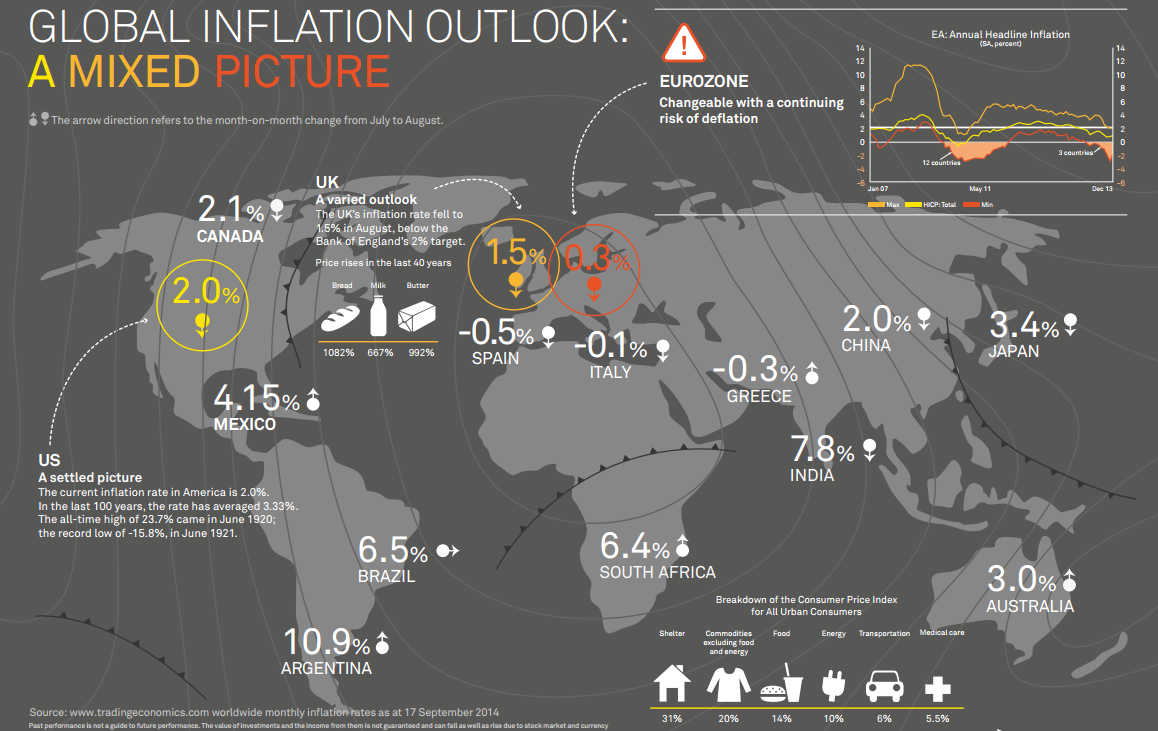

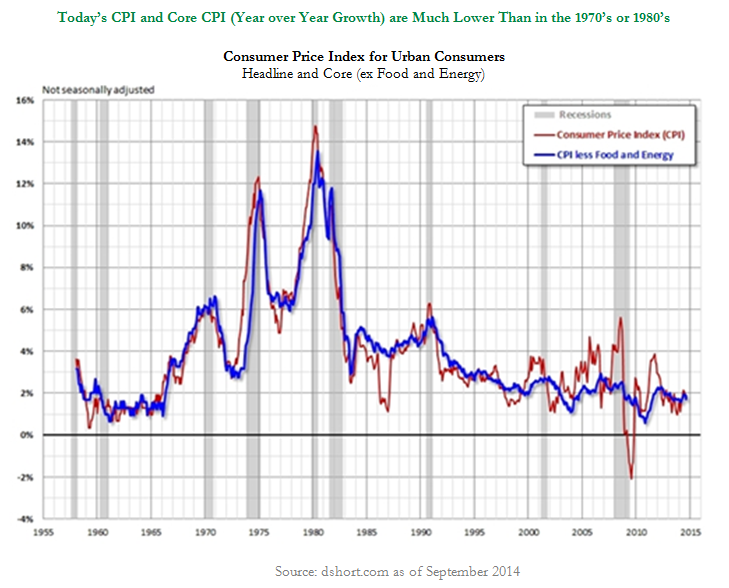

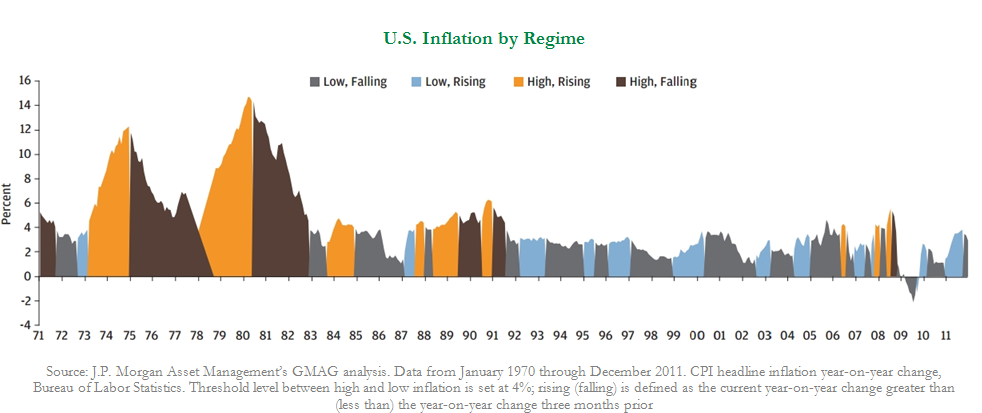

• We do not have inflation concerns in the short term. Southern Europe even sees some deflation, which is a decline in prices that could also be terrible for a country. We believe that reported inflation will come back in the mid to long term. Reported inflation is currently below target in most OECD countries.

• Certain types of investments could protect you against inflation. However, their effectiveness, reliability, and cost vary.

• There is a small cost to protect against inflation, but it should provide valuable protection: it will reduce the large loss in purchasing power that a traditional stock/bond portfolio is likely to suffer.

• One way to prepare yourself against inflation (to hedge) is to diversify your portfolio beyond traditional stocks and bonds, by including real assets (commodities, real estate, global REITS…), and inflation-linked bonds (TIPS).

Don’t be fooled by people who claim that there’s no inflation.

Introduction

What is inflation? Is inflation bad for your portfolios? Should you be selling your mutual funds if there is higher inflation? What type and how much inflation protection is appropriate?

Most portfolios are not designed to protect against inflation.

Following aggressive fiscal and accommodative monetary policies since 2008 (also called quantitative easing), some of you have concerns about inflation globally and its negative impact, declining purchasing power. Inflation means that your money won’t buy as much today as it could yesterday. In simple words, rising inflation means that the same amount of goods that you can buy with your money today will cost more tomorrow. Inflation is the reason your grocery bills are relatively higher every month. It is defined as the rate (%) at which the general price level of goods and services is rising.

Inflation may not have been headline news for many years, but prices for many everyday items have increased dramatically, making an adverse impact on investors' wallets. For example, the price of one dozen eggs went from $0.97 in 2000 to more than $2 in 2014. With the rising price of everything from energy to food, we are forced to spend a larger percentage of our earnings on necessities.

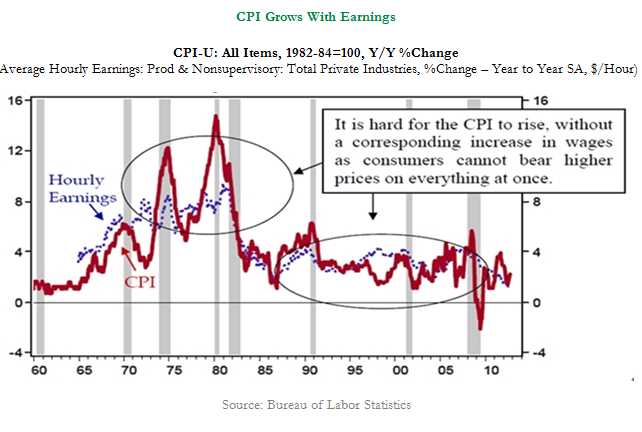

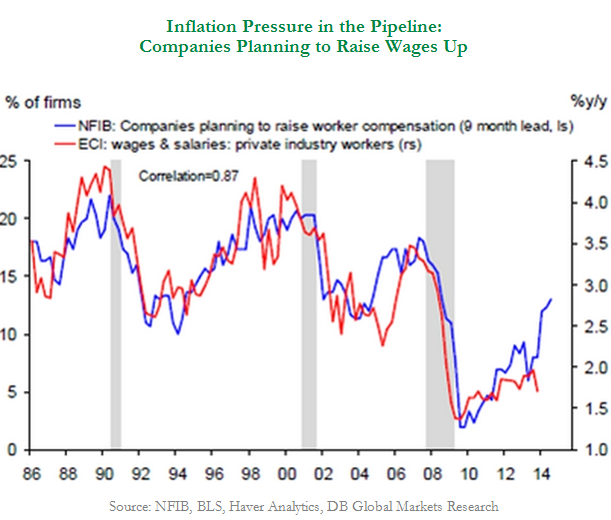

Labor costs may soon increase as U.S. has a need for high-skilled, highly-educated workers, and a lot of corporations are saying they cannot find the skilled workers they need.

You don’t buy home insurance because you think you will have a fire tomorrow. We can see inflation in the same way. You may not have concerns about a spike in inflation tomorrow, but who knows when inflation will come? Remember to buy the protection ahead of the fire… We believe in investing in protection against inflation today for a better and safe tomorrow.

At BFM, we are keenly aware than most people "feel" and "see" inflation that seems well higher than the government-stated numbers.

"By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some... Those to whom the system brings windfalls,... become "profiteers," who are the object of the hatred... the process of wealth-getting degenerates into a gamble and a lottery... Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose." Source: J.M. Keynes

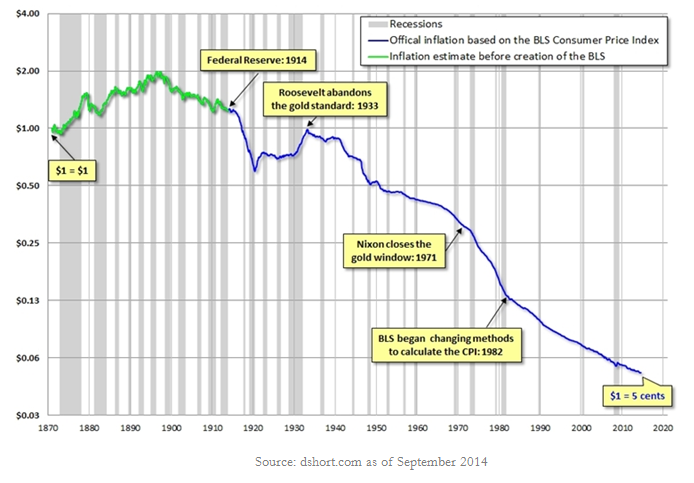

To get a better idea of how inflation can eat up your wealth, you can see that $1 in 1920 is equivalent to 5 cents in 2014.

The main drivers of future inflation are wages (salary) and inflation expectations. The U.S. government is also talking about raising minimum wage. Inflation can be a stealthy thief to investors.

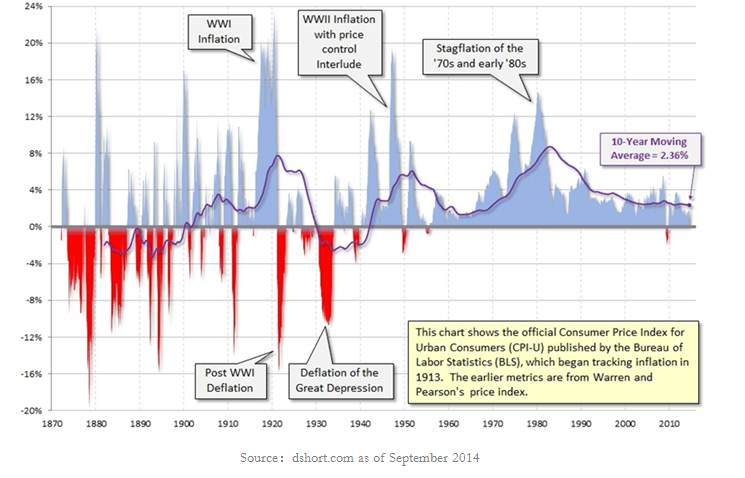

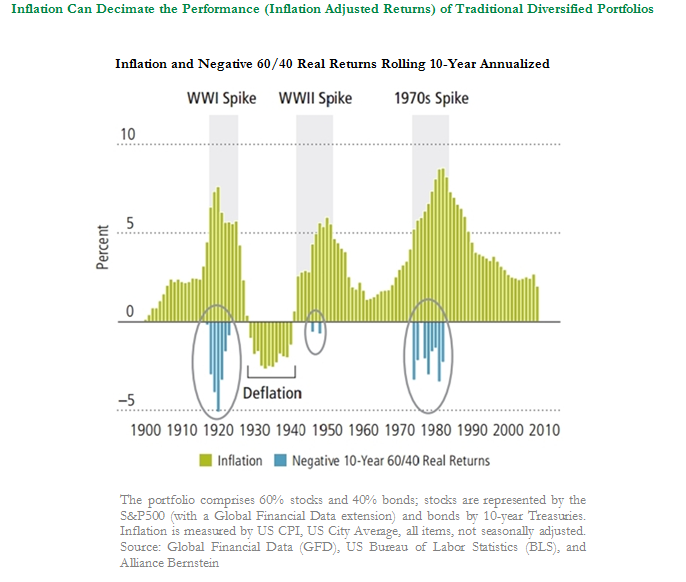

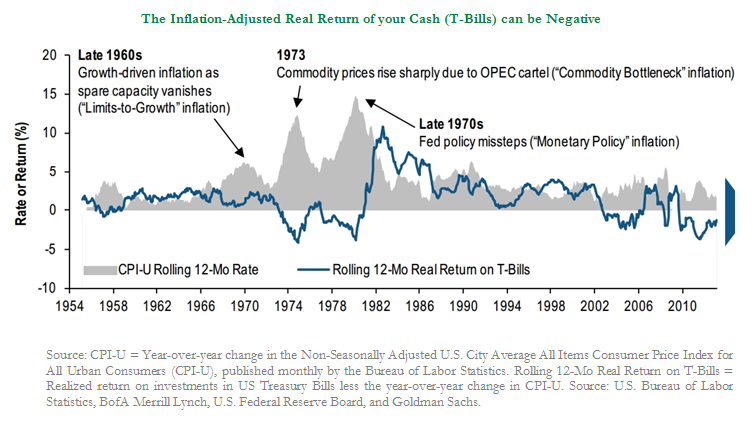

To give you some perspective, this chart shows the historical inflation since 1872. The last period of high inflation was in the 1970’s.

A good complementary reading is an article by Gary Halbert: Is the Government lying to us about inflation? Yes!

We note that inflation is good for debtors because it allows them to repay their debts in devalued dollars. The weight of your debt decreases when the purchasing power of the dollar decreases with inflation. A home mortgage is a hedge against inflation.

Inflation also encourages spending rather than keeping your money in cash.

1. Impact of Inflation

How does inflation impact you?

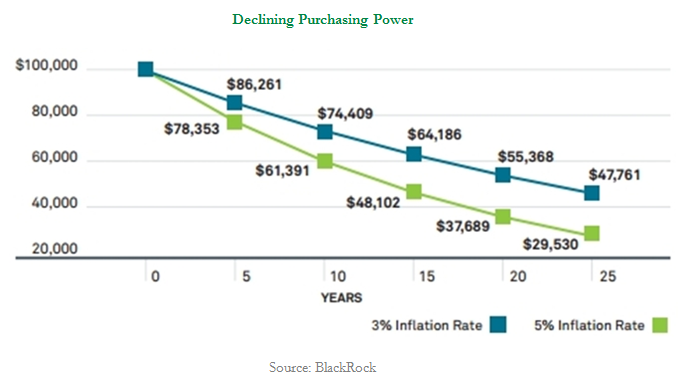

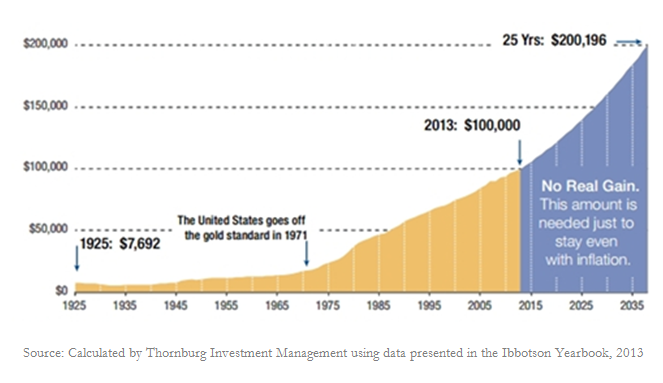

A common goal of most investors is to maintain the long-term purchasing power of their investments but in 25 years, $100,000 will be worth the equivalent of today’s $47,761 assuming 3% annual inflation.

If investors do not take steps to hedge against the impact of inflation, their retirement portfolios may be negatively impacted.

$100,000 in 2013 had the same purchasing power as $7,692 in 1925. If inflation stays at 2.82% (like the past 30 years) in the next 25 years, you will need $200,196 to buy the equivalent of $100,000 of the same goods/services today.

In the following chart we see how inflation has impacted the tuition rates and the medical care the most.

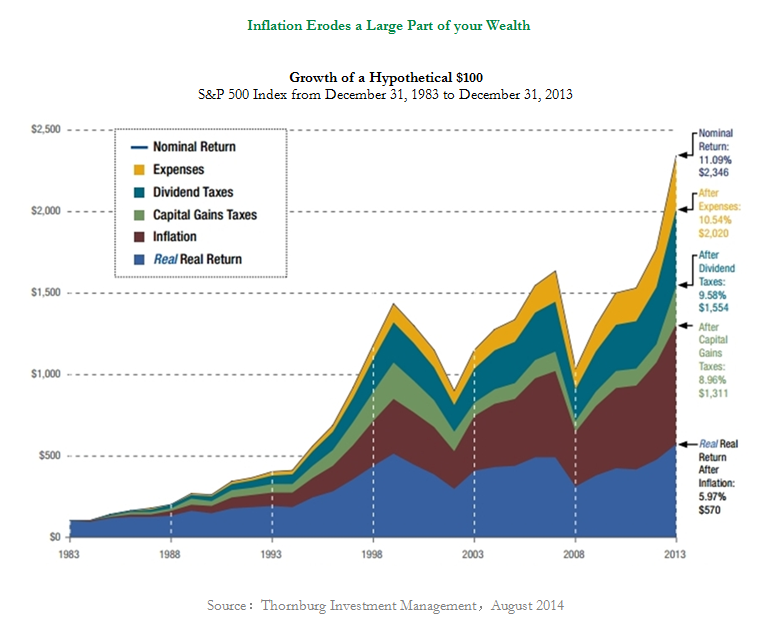

The following graphic also gives us an interesting perspective of how inflation reduces the total return on our investments. For example, a nominal return of 11.09% which might sound really good at first comes down to 5.97% after adjusting for different expenses and inflation numbers.

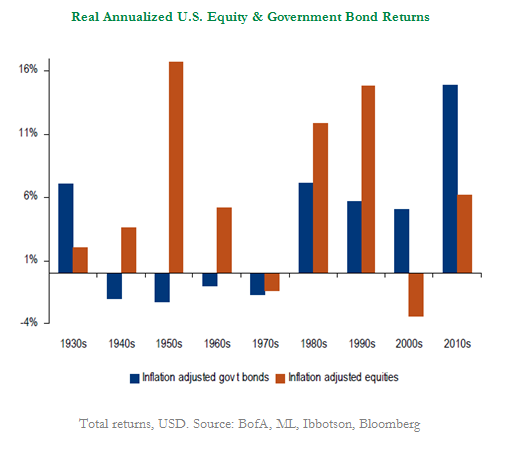

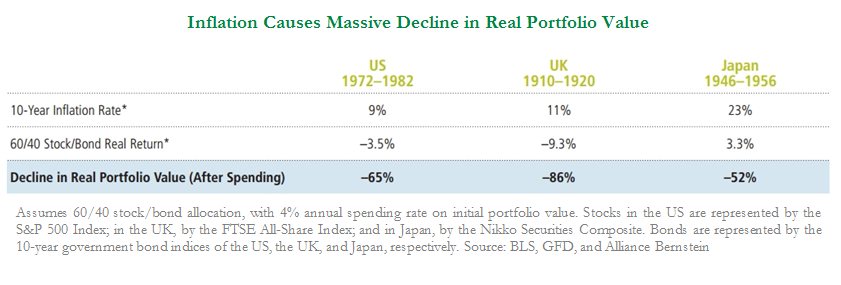

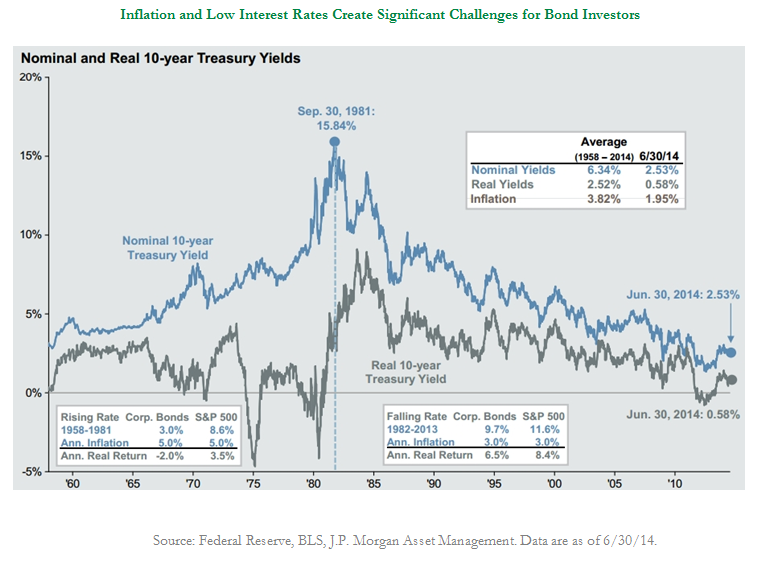

The performance/returns of stocks and bonds can look very different when adjusted for inflation.

In the 1940's, 50's, 60's, and 70's, U.S. Government bonds had negative returns after adjusted for inflation.

We note that retirement could last for a long time. Advances in health care are helping people to live longer than ever before. A married couple reaching age 65, has a 70% chance that at least one of them reach age 85, and a 47% chance that at least one of them reach age 90 (source: Society of Actuaries 2000 Annuity Table).

You should prepare retirement portfolios for income needs.

2. What is the Consumer Price Index (CPI)

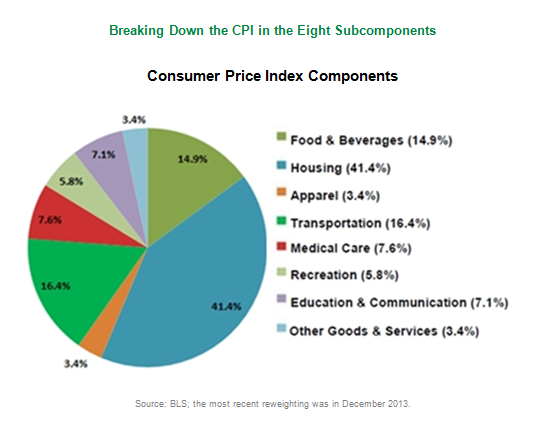

The CPI affects the economy because cost of living adjustments to social security, federal retirement, and supplemental security income are tied to it. It’s also used to index income tax parameters, and TIPS (Treasury Inflation-Protected Securities that are bonds used to protect against inflation).

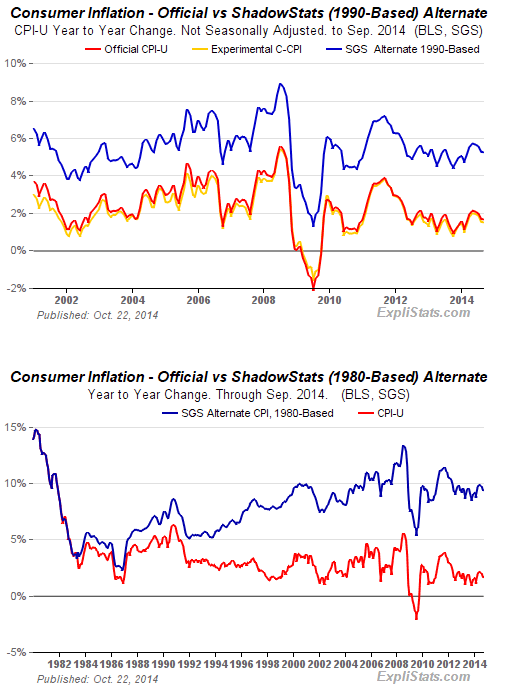

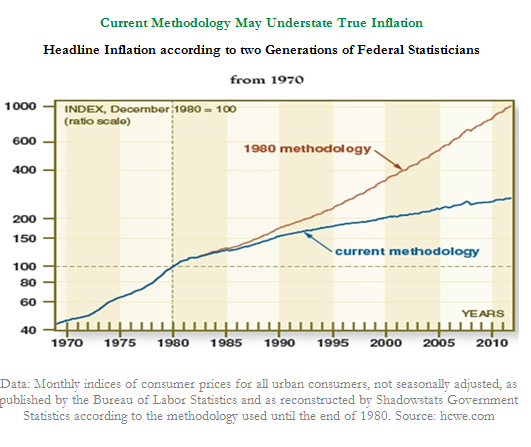

We believe that CPI is a controversial measure. Many argue that it is not a very accurate indicator.

We agree with Gary Halbert: over the years, the methodology used to calculate the CPI has also undergone numerous revisions. According to the BLS, the changes removed “biases” that caused the CPI to overstate the inflation rate. The new methodology takes into account changes in the quality of goods and “substitution.” Substitution is the change in purchases by consumers in response to price changes, and this alters the relative weighting of the goods in the basket. The overall result tends to be a lower CPI.

"Quite simply because it’s a government report that’s been frequently manipulated over the last 35 years. Whether by design (my bet) or coincidence, these revisions have served to reduce the official inflation rate. Also, keep in mind that our government has a record $16.7 trillion in debt it is paying interest on. If interest rates rise, it costs Uncle Sam more money. If inflation rises, interest rates follow. Obviously, the government has incentives to manipulate the official inflation rate lower than it really is." Gary Halbert.

Economists using different methodologies (including the original methodologies) estimate that the real U.S. inflation rate is anywhere between 5% and 8%. That’s a huge difference with the official reported figures!

The true inflation may be higher than the official reported inflation.

Some people argue that Governments have 2 choices:

1) mislead its citizens by understating inflation

2) release accurate inflation data but it will increase social benefit obligations

3. How to Protect Against Inflation: Asset Allocation

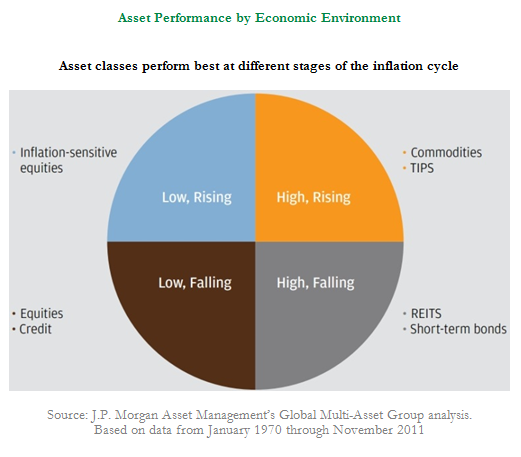

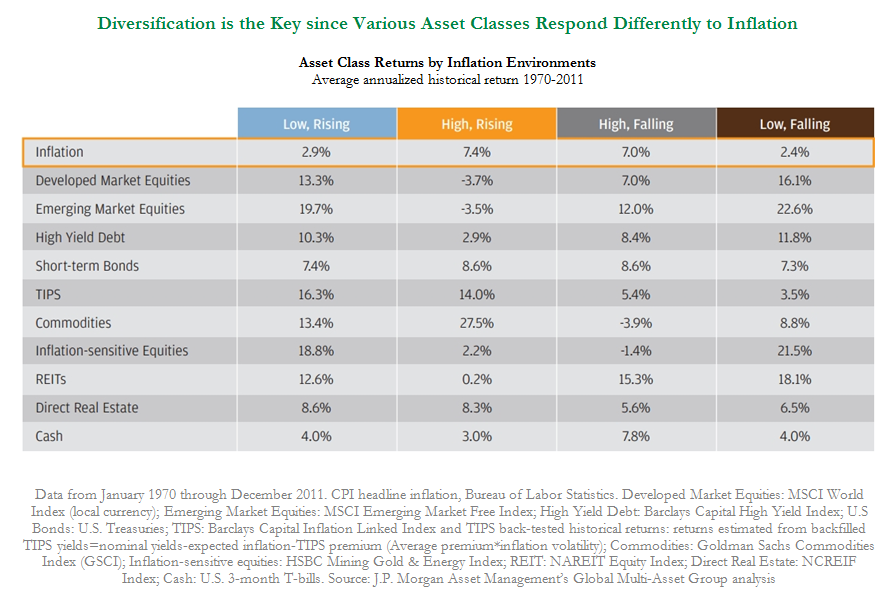

In this section, we would like to present some more graphics which can give you some perspective of how you can hedge yourself against inflation and what assets could be used.

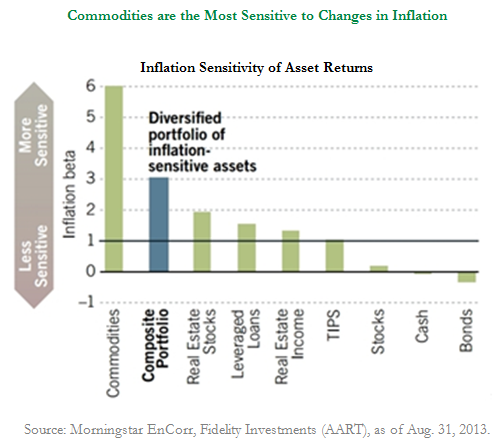

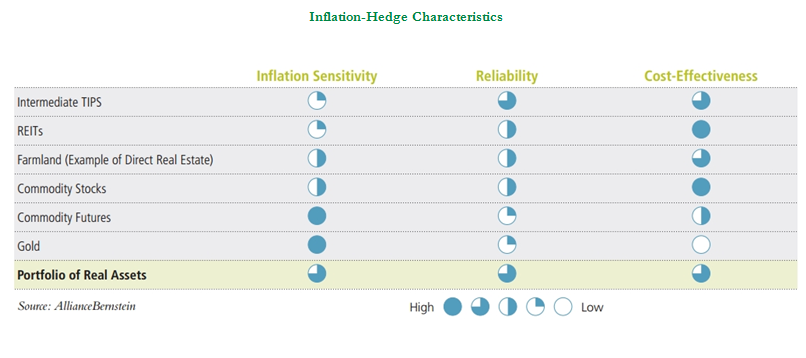

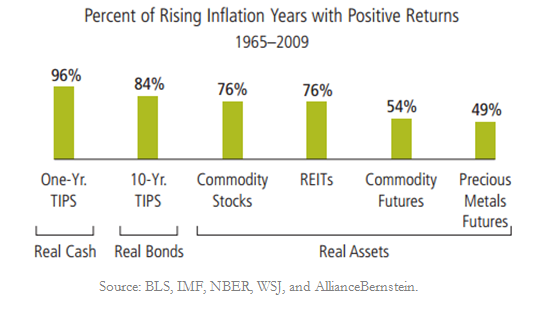

Inflation beta means the sensitivity to inflation. Inflation can have a positive impact on an asset’s value when prices are rising. The chart above shows that commodities are the most sensitive to inflation. Unfortunately, the reliability/consistency of commodities as an inflation hedge is not great but when they have worked, they have worked exceptionally well.

It seems that the greater the inflation sensitivity, the lower the reliability.

We can see below that TIPS have been much more reliable in protecting against inflation.

In summary, many different assets can provide a hedge against inflation, but their effectiveness, reliability, and cost-effectiveness vary (foregone return potential).

One way to prepare yourself against rising inflation (to hedge) is to diversify your portfolio beyond traditional stocks and bonds and include real assets (commodities, real estate, global REITS…), inflation-linked bonds (TIPS), and stocks including natural resources. Finally, investing in foreign currency may help to increase the reliability of your inflation protection.

Discover Past Newsletters

We would welcome the opportunity to know you better, introduce ourselves, share with you the work we do for our clients, and position ourselves as a useful resource for you. It would be a wise first step towards achieving your vision.

Getting to know you, your needs and motivations, is almost as important as you evaluating our capabilities to help you meet your financial goals. We do not charge a fee for our initial consultation during which we review your portfolio, and listen to your goals and objectives.

What type of clients do we have? Our clients are located across the globe including North America, Europe and Asia. We have an unbiased approach in selecting our clientele i.e. our client base is broad encompassing expatriates, executives, entrepreneurs, working professionals, and business individuals. We welcome all clients from individuals with wealthy multi-million dollar portfolios to individuals who currently have negative net worth.

We have no portfolio size minimums.

Learn more about our straightforward flat fee conflict-free compensation model.

We have discovered that one of the most valuable things we do for our clients is guiding them on selecting better mutual funds and making sure they have enough assets as long as they live. If you have any ideas on how we should connect with people in such situations, your advice would be a great help.

This newsletter was first published in October of 2014

https://us4.campaign-archive.com/?u=573d134676472fe56336c7f4f&id=ebe8ad4fc8&e=d68f9c2d38