How to reduce taxes

How to Reduce Taxes? Let's Learn More About the U.S. Tax System!

• Are you curious to know how the recent tax changes will affect you?

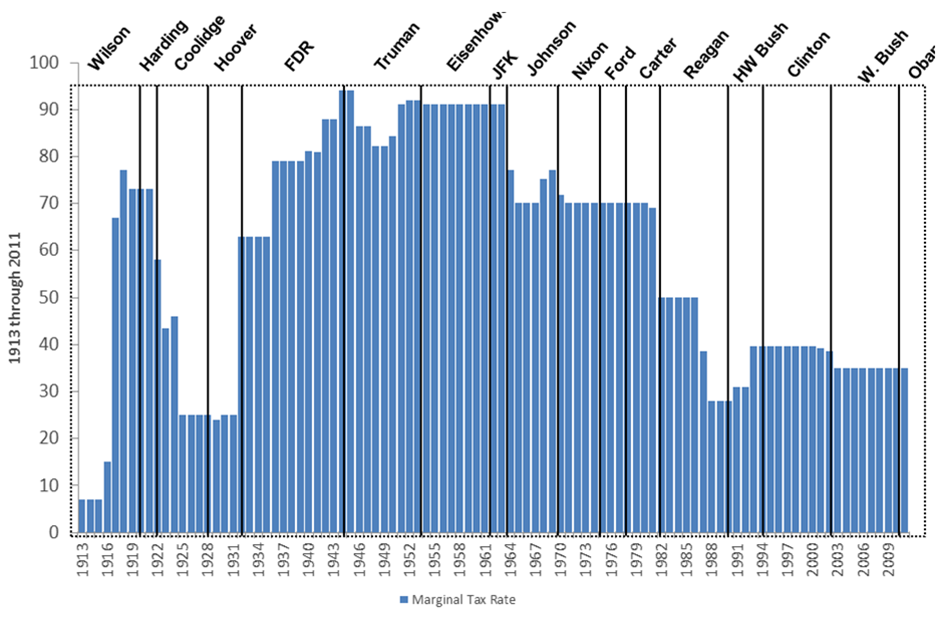

• The last time the top individual marginal tax bracket increased was 1993. The maximum marginal tax rate of 31% in 1992 was raised to 39.6% in 1993.

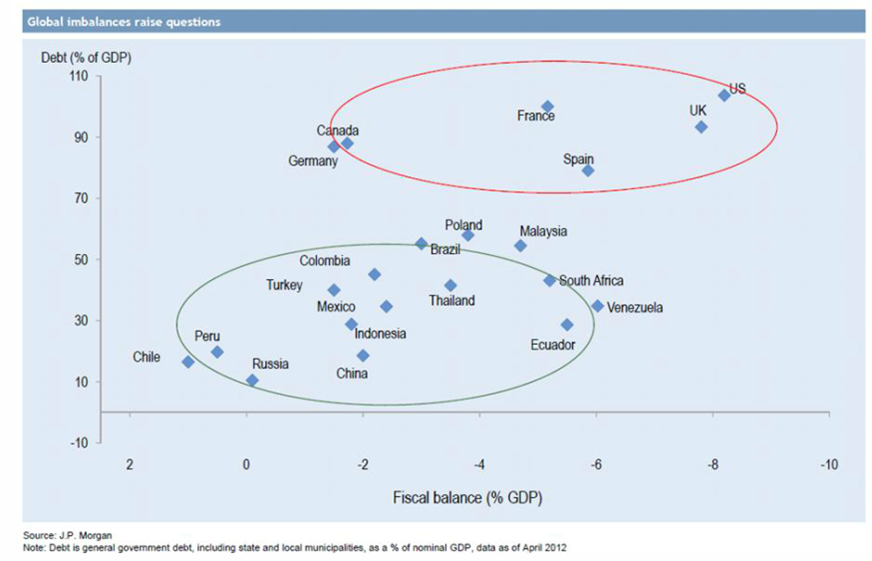

• The U.S. has not run a budget surplus since 2001. Federal debt is more than 100% of GDP, the highest in over 60 years. When the present value of social security and healthcare liabilities is taken into account, the debt-to-GDP ratio may climb to more than 300%.

• Our goal is to help our clients understand how additional tax increases could impact their lifelong investments and portfolios.

Click Here to Discover the New BFM Newsletter!

• We would like to highlight one of the many tax reduction strategies available. Additionally the newsletter provides insights into various tax related topics by studying historical data and trends.

• To combat the negative fiscal balance and reduce the debt burden, the U.S. government may continue to increase its revenue stream by raising taxes. Other states may follow the example set by California; it has just raised taxes by 30%, retroactively.

• With the continuous down-trend in income tax rates from a high of 94% in 1944, taxes collected by the U.S. government as a percent of personal income are currently at its lowest in over 50 years.

• The good news is that U.S. stocks have achieved a five-year high and more than doubled in the last 4 years (more than 130% since March 2009).

• Returns for stocks have been positive for 9 out of the last 10 years. In the last 10 years, U.S. Large Cap stocks were up 7% per year on average, U.S. Mid Cap stocks up 10%, World stocks up 8%, and Emerging Markets stocks up 17% (or 380% in cumulative terms).

• 2012 was another great year for markets around the world with U.S. and World stocks up 13%, Japan +23%, India +26%, Greece, Germany, Philippines and Thailand all around 30%, and returns in Turkey crossing 50%!

• Furthermore, in 2012, the S&P 500 had a gain of 16.0% (total return). If you missed the 3 best percentage gain days last year, the 16.0% gain falls to a 8.4% gain. Finally, the Russell 2000 closed at an all-time high in January.

U.S. Has Too Much Debt and a Negative Fiscal Balance

Marginal Income Tax Rate from 1913 to 2012

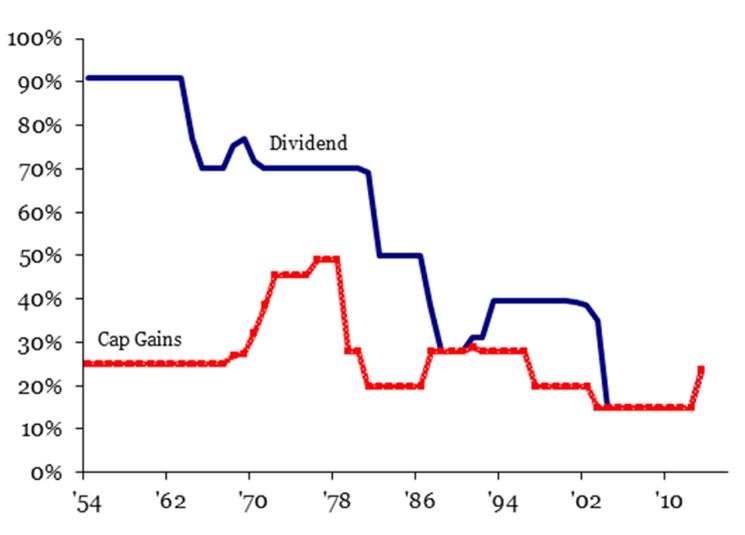

The Dividend Tax Rate Has Converged Down to The Capital Gains Tax Rate Over Time

• In conclusion, we believe U.S. tax rates may continue to go up. Don't hesitate to contact us to discuss financial and tax planning strategies. BFM and its integrated approach to strategic asset allocation is ready to help you optimize your tax benefits. We do not sell financial products but we help our clients by offering conflict free and prudent tailored advice services.

Did You Know?

• The actual total cost of 4-years of college education at an average public in-state university for the years 1978-82 was $9,894 (after adjusting for inflation it was $28,491). For the years 2008-12 it was $62,869. Thus, the cost of obtaining a 4-year degree has increased +127% over the last 30 years.

• 45% of first-time home buyers in 2006 purchased their home with no money down (source: National Association of Realtors). The total value of U.S. Household equity ownership in real estate dropped by more than $4 trillion falling from $10.3 trillion as of 12/31/07 to $6.1 trillion as of 12/31/11.

• An estimated 7,600 Americans turned 65 years old each day in 2011. An estimated 11,400 Americans will turn 65 years old each day until the year 2029.

• An average American couple retiring at age 65 today would need a present value lump sum of $230,000 to cover future health insurance premiums and out-of-pocket medical expenses over the remainder of their lives.

• In 2012, the U.S. labor force participation rate was 64%, a 31-year low, the real median household income was at a 42-year low, and 15% of the U.S. population was on food stamps.

• Social Security recipients (17% of the population) have only 3 workers supporting each recipient as compared to 42 in 1935.

This newsletter was first published in February of 2013

http://www.bourbon-fm.com/file/BFM_Newsletter_01_2013_Tax.pdf