Capital gains - taxes on a loss

Capital Gains - You May Have to Pay Taxes on a Loss!

You meet with your accountant and he informs you that you need to pay capital gains taxes even though the mutual fund you bought posted negative returns. You have not sold any funds or made any portfolio changes. How does this happen?

Why do some people need to pay capital gains taxes if they lost money and did not trade?

Executive Summary

When you own a mutual fund in your brokerage account, you may have to pay taxes even though the value of your fund went down, even if you did not sell the fund or realized any gains. It is important to know which funds may generate lots of taxes and to optimize your asset location (brokerage, 401 (k), IRA... accounts) of each fund you own.

Details

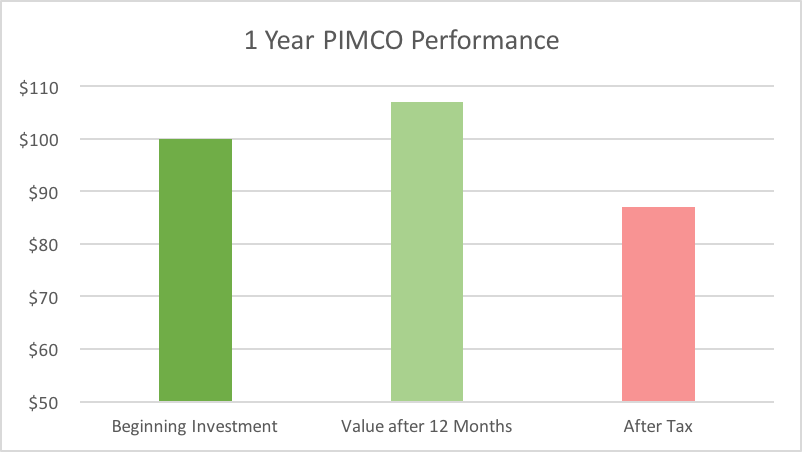

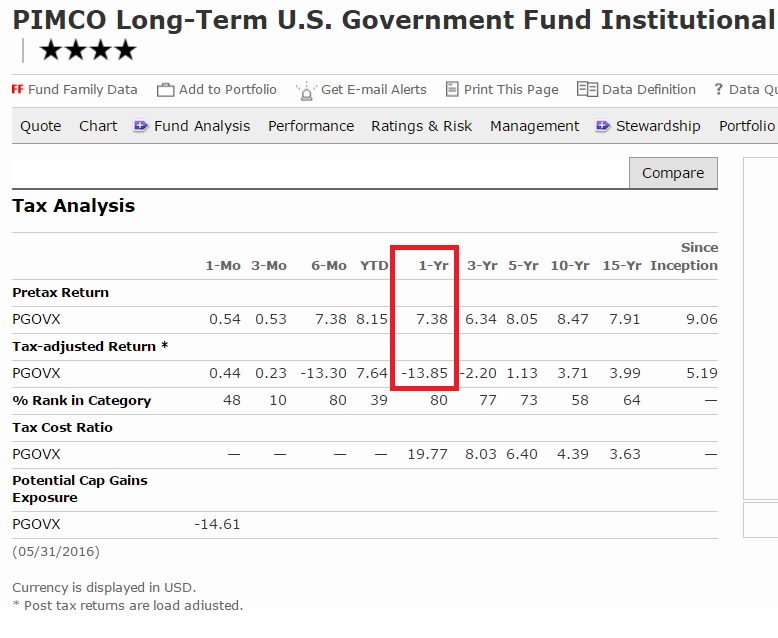

If you check www.morningstar.com, you will see the difference in performance before and after-tax. In the last 12-months, taxes may have decreased the performance of PIMCO Long-Term U.S. Government bond fund by more than 21% in a regular taxable brokerage account!

The fund has suffered some withdrawals / outflows (fund redemption by shareholders) in the last two years which created this large difference. The outflows required the fund manager to sell securities (stocks, bonds...) triggering the capital gains.

Although the fund performed well this last twelve months with a return of over 7%, its after tax return was a loss of over 13%. This occurred as many investors in the fund chose to withdraw money from the fund. As a result, the fund manager was forced to sell many securities to cover the redemption. The process triggered capital gains tax.

Imagine you invested $100 in the fund one year ago, you would have lost nearly $14 as a result of taxes on assets that were in the fund before you had even invested in the fund.

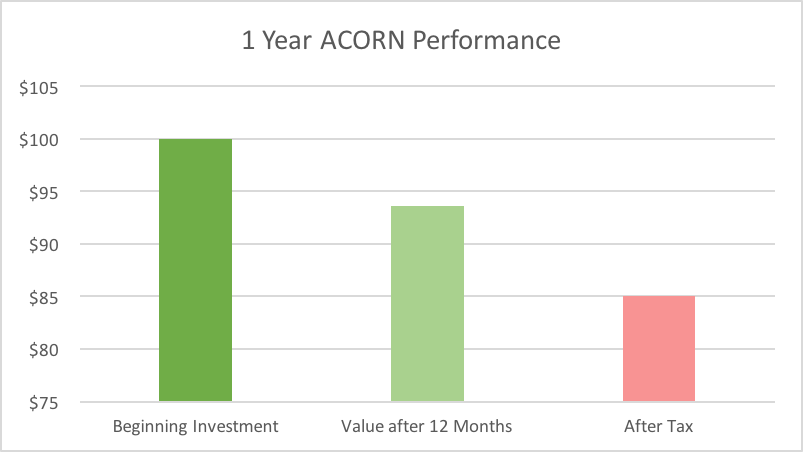

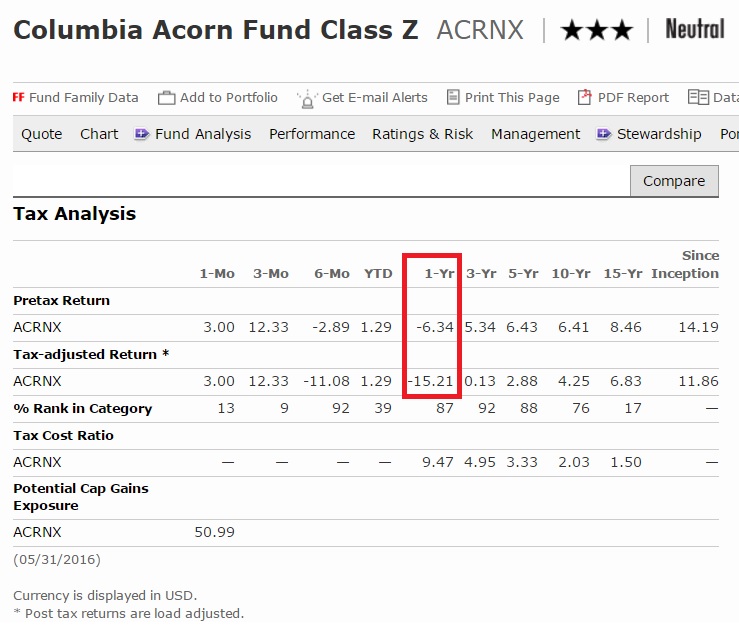

Taxes can have significant effects on stocks as well. An example would be the well-known Acorn fund from Chicago, which was one of the best funds between 1970 and 2010. In the last 15 years, the fund has outperformed the S&P 500 or its category (top 13%) by more than 2% per year. In the last 12-months, taxes may have decreased the performance of Acorn by more than 9% in a regular taxable brokerage account even though the fund performance was negative!

If you bought $100 of Acorn one year ago, you may have about $94 today. In addition, you had to pay $9 of capital gains tax (IRS form 1099-DIV).

Mutual funds pass through capital gains that are only recognized when a holding or security is sold, so the fund manager can postpone capital gains. That creates a liability for unrealized gains that a new buyer/shareholder picks up when he buys into the fund. A mutual fund with large outflows will be forced to recognize these gains. Acorn's shareholders experienced this in the last few years.

Even without selling shares of a fund, investors can incur capital gains taxes triggered by the sale of individual securities by the fund manager.

Key Takeaways

Investors buy mutual funds because it is simple but we recommend looking into finer details, specifically tax ramifications of any financial security before making a decision to invest. Some funds have a high turnover and may generate high taxes. Even though stock performance has been weak in the past twelve months, many mutual funds still have highly appreciated securities in their portfolios following the stocks' seven-plus-year rally (U.S. stocks are up 250% since March 2009); those gains haven't been taxed yet.

If there is a change in a fund manager, it may prompt the sale of those highly appreciated securities by the new fund manager. Those gains must then be distributed to shareholders and are taxable.

Note that investors in funds or ETF owned in non-U.S. bank/brokerage accounts may also have high U.S. taxes on a fund that went down in value and that was not even sold due to PFIC rules!

Taxes are one of the few guarantees in life.

Tax strategies can minimize the amount you may need to pay.

Income and capital gain distributions from holdings inside of an IRA, 401(k), 403(b), 529, or HSA accounts don't have any tax consequences unless you withdraw from them for non-qualified distributions. Even funds with low-turnover strategies and historically low capital gains distribution may have investment process changes that lead to higher capital gains distributions.

There are differences between short- and long-term capital gains. The former are worse than the latter because they're taxed at your ordinary income tax rate which may be higher. You can receive information about this topic from your fund manager in November and December. Some investors prefer to sell a fund before it makes large distributions. It is also good to know that if you're reinvesting the distributions from your fund, you can adjust your cost basis upward to account for them (and pay less taxes later).

SUMMARY: ASSET LOCATION OPTIMIZATION

When possible, some investors put fixed income, commodity, real estate (REITs), high dividend paying stock, money market funds (which generates ordinary income or short-term capital gains), and stock funds with high turnover in tax-deferred accounts like 401(k), 403(b), IRA, , HSA, VA, VUL, 529…, and put equity funds (low turnover or international) in taxable accounts.

If you have any questions about how this pertains to your investments or your portfolio, don't hesitate to email or call us!

- BFM helps you make better, more informed financial decisions by giving straightforward and conflict-free diversified strategies to maximize asset growth and reduce downside risk.

- BFM makes sure that you have enough assets for your entire life so that you can enjoy a comfortable retirement with a secured income.

- BFM gives you a financial plan with personalized guidance to keep your portfolios on track with your goals. We neither sell any products nor get any incentives from any specific services. You keep control of your financial accounts.

- BFM will continue to monitor and adjust your financial plan as your needs and circumstances change.

- BFM offers you a positive investment experience by providing comprehensive and focused financial planning services.

- BFM analyzes your entire financial life to create peace of mind for you and your family. BFM also helps you identify your financial goals by understanding and analyzing your lifestyle. Finally, BFM will help you see the big picture and show you how your plan will create a sustainable lifestyle for you in future years.

This newsletter was first published in June of 2016

https://us4.campaign-archive.com/?e=[UNIQID]&u=573d134676472fe56336c7f4f&id=84b4d3b1ee