24 painful mistakes to avoid to boost peace of mind

24 painful mistakes to avoid to boost peace of mind

Today, reaching your financial goals (retirement, college education, new home...) is more complex than before. The future performance of portfolios will be lower, and tax laws are becoming harder.

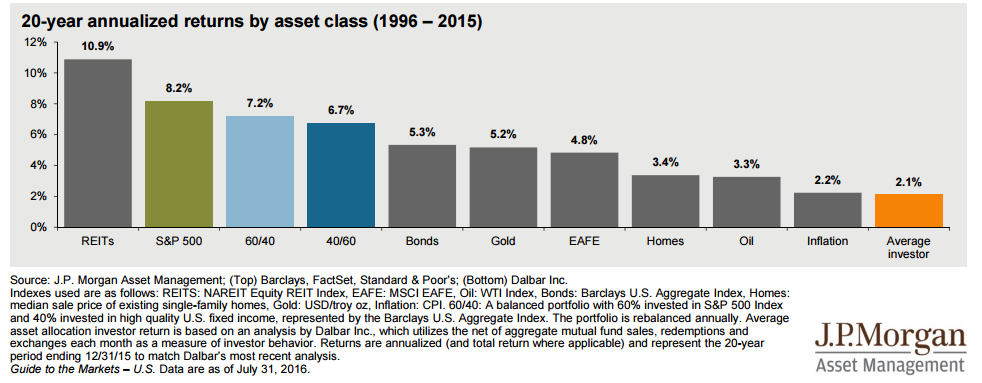

In August, I introduced to the CFA Society of Chicago Dr. David Kelly from JP Morgan. His newly released investor guide aggregated long term information on the performance of the most common asset classes (stocks, bonds, gold...). It is always a good reminder to see that the returns achieved by the ‘Average Investor’ significantly underperformed every single asset class from which this investor’s portfolio may be composed of.

- $100,000 invested in 1996 by the average investor would have become $151,536.

- $100,000 invested in 1996 in the U.S. stock index (S&P 500) would have become $483,666 ($332,130 or 219% MORE!).

What causes the average investor to perform so poorly?

In this newsletter we will examine common errors that investors of all skill levels are inclined to make.

- How do you really know if the decisions you’ve made so far are the best ones to reach your financial goals?

- How do you know that you’re not making a mistake today?

Following 20 years of investment experience, here are 24 preventable tax and investment mistakes that we have seen.

These mistakes can ruin your retirement planning and prevent you from reaching your dreams.

Summary

1. Not diversifying your wealth

2. Not understanding the risk in your portfolio

3. Investing in tax inefficient portfolios

4. Doing nothing / Failing to build a customized financial plan

5. Not saving enough or saving too late

6. Overlooking your adviser/broker fees

7. Failing to rebalance your portfolio

8. Not having a sufficient emergency cash reserve

9. Being overconfident in your own abilities

10. Chasing past performance

11. Investing based on news or reacting to short-term returns

12. Emotionally buying/selling

13. Trying to time the market

14. Selecting the wrong mutual fund

15. Not taking into account the effect of inflation

16. Buying what you don’t understand

*** Specific mistakes made by expatriates (70% of BFM clients!) ***

17. Failure to report investment income from assets held outside the United States

18. Failure to properly report foreign financial assets

19. Failure to understand FATCA and the impact of investing in a non-U.S. account (fees, taxes, tax reporting,…)

20. Failure to analyze your portfolio's true exposure to currency risk and its impact on your wealth

21. Failure to financially plan the move in or out of the U.S.

22. Failure to understand the link between un-excluded earned income and IRA contributions

23. Failure to update your estate documents

24. Failure to work with a competent tax accountant and financial adviser

1. Not diversifying your wealth

Asset allocation is an arena of investment where you actually have control over your portfolio expected returns and volatility. Asset classes (stocks, bonds,…) are affected differently depending on market and economic conditions.

The Brinson study showed that the vast majority (91.5%) of variation in portfolio returns could be explained by your asset allocation.

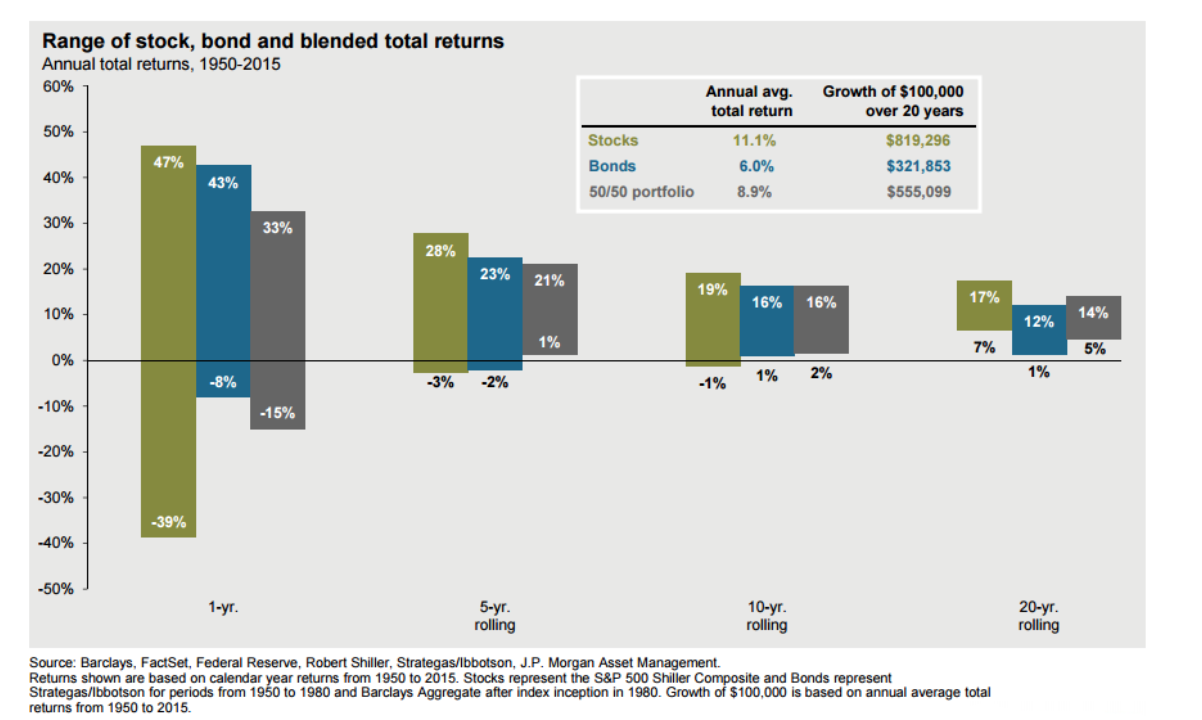

As you can see below, stocks have historical demonstrated a higher level of return than bonds but do so at a higher volatility. If you need to have access to your assets in the short term, investing in stocks can be dangerous.

Diversification works!

Portfolios should also be diversified between U.S. and International stocks.

One's wealth should be looked at from a wide perspective: not only the portfolios but also real estate, currency exposures, and the human capital (that reflects the person’s ability to earn and save throughout their lives).

>> Make sure your wealth and portfolio asset allocation are in line with your objectives and loss tolerance.

2. Not understanding the risk of your portfolio

“Risk comes from not knowing what you're doing.” (Warren Buffet)

>> Your portfolio should be tested to understand how it would have behaved in past downturns like in 2001 or 2008.

3. Investing in tax inefficient portfolios

Are you using your 401(k) and IRA accounts in an optimal way?

Tax has a huge implication on the long run returns as different securities are affected by tax laws differently. Refer to the BFM past newsletter (here) for more detail on this issue.

>> Professional guidance may pay for itself through the tax optimization of your portfolio.

4. Doing nothing / Failing to build a customized financial plan

"A man who does not plan long ahead will find trouble right at his door." (Confucius)

If you don't know the destination, how will you know when you've arrived? A plan will help you see whether your goals are realistic, especially for your timeline. It will allow you to measure your progress on your goals and make you more confident with your money.

>> Spend a little time to spell out your goals, how you'll meet them, and the role of each investment. Your life will become easier and less stressful.

5. Not saving enough or saving too late

A third of Americans have $0 saved for retirement, according to a 2016 GOBankingRates.com survey. The survey found, 56% of Americans have less than $10,000, and 75% of Americans over 40 are behind in their savings.

>> Check with your adviser if your after-tax inflation-adjusted retirement income will meet your needs.

6. Overlooking your adviser/broker fees

In the next 10 years, stocks performance may be around 6% annualized, bonds around 2%, so a balanced 60% stocks / 40% bonds portfolio may have a performance of 4.4%. If you deduct taxes on capital gains, interests, dividends…the performance may be closer to 3% depending on your tax brackets and the securities your own.

In addition, inflation may reduce your returns by 2% so your potential real return after tax of your portfolio may be closer to 1%.

If you pay your adviser/broker a 1% fee, you may end up with a 0% real return!

>> You should not pay any commissions or an investment adviser fee based on the percentage of your assets (typically 0.5% to 1.5%) which, by the way, also creates many conflicts of interests. By contrast, the innovative BFM retainer fee model (used since inception in 2009) avoids many of the inherent conflicts of interest embedded in the asset under management model used by most advisers.

7. Failing to rebalance your portfolio

The goal of a rebalancing strategy is to minimize risk.

>> Rebalance regularly so that you'll be buying low and selling high.

8. Not having a sufficient emergency cash reserve

Building a cash reserve for emergencies will help you breathe a little easier. Everyone should set aside a little extra cash in case of a job loss, medical expense, or other emergency.

>> Keep 6 to 12 months' worth of living expenses in an online savings account (~1% APY).

9. Being overconfident in your own abilities

“The investor’s chief problem – and even his worst enemy – is likely to be himself.” (Benjamin Graham)

As you can see in the introduction, or in the table below, the average investor underperforms.

If you are managing your assets yourself, you may be interested in reading this article.

>> Be humble, disciplined, have a proven process, use checklists, and read the BFM newsletters on investor psychology at www.bourbonfm.com/resources-tips.

10. Chasing past performance

“Past performance does not guarantee future results”.

>> Focus on the long term and your goals.

11. Investing based on news or reacting to short-term returns

In line with performance chasing, the inclination to make investments based on short term news drives lower returns. Many investors shoot from the hip in reaction to news without careful due diligence or consideration of the long term.

The short-term direction of the market is unpredictable. Selling in reaction to market moves implies that you can predict short-term moves.

For example, on June 23rd 2016, U.K. decided to leave the European Union. The British pound fell 8% against the U.S. dollar. The Euro Stoxx 50 was down 8% (European stock index), and the FTSE 100 (British stock index) fell 4%. As you can below, after the initial over reaction to the news, the FTSE is now 10% higher than before Brexit!

>> Don't get stressed watching business TV or tracking the market online. It may be exciting and informative but not always helpful for long-term investors.

12. Emotionally buying/selling

Buy low and sell high is the timeless adage for making profit in markets. In contrast, emotional swings in market sentiment cause investors to do the opposite in practice.

Human nature makes us risk averse when hit with sudden market drops and overly optimistic as markets rise. A long time horizon cancels out the noise of investor sentiment.

>> “Only buy something that you'd be perfectly happy to hold if the market shut down for 10 years.” (Warren Buffet)

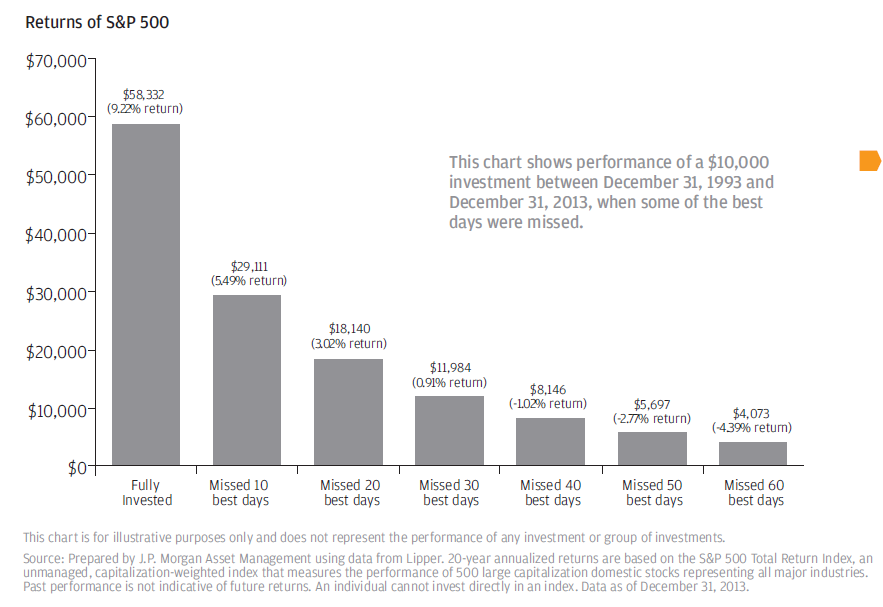

13. Trying to time the market

Assuming too much about your own predictive capabilities is one of the primary deadly sins amongst investors of all experience levels. Commonly, losses occur as a result of investors predicting a downturn and exiting the market, and consequently missing out on potential return as the market continues to climb.

Hindsight reinforces this bad habit, as investors tend to attribute positive investment decisions to skills rather than chance. They interpret failure as the result of bad luck. The best investors do not try to time the market. They rather establish a margin of safety with their investments so that they can meet their investment goals under any market conditions.

>> Don’t check the markets or your portfolio often.

14. Selecting the wrong mutual fund

Based on this research, only 0.6% of all U.S. fund managers are “skilled” and succeeded in consistently picking more stock winners than losers between 1975 and 2006.

>> Cheap index funds/ETF may help you reach your goals faster.

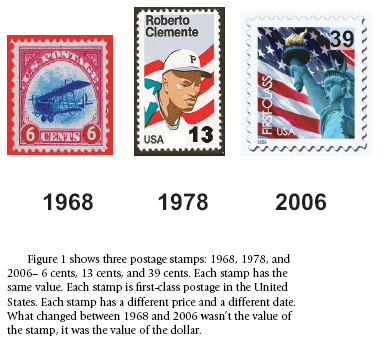

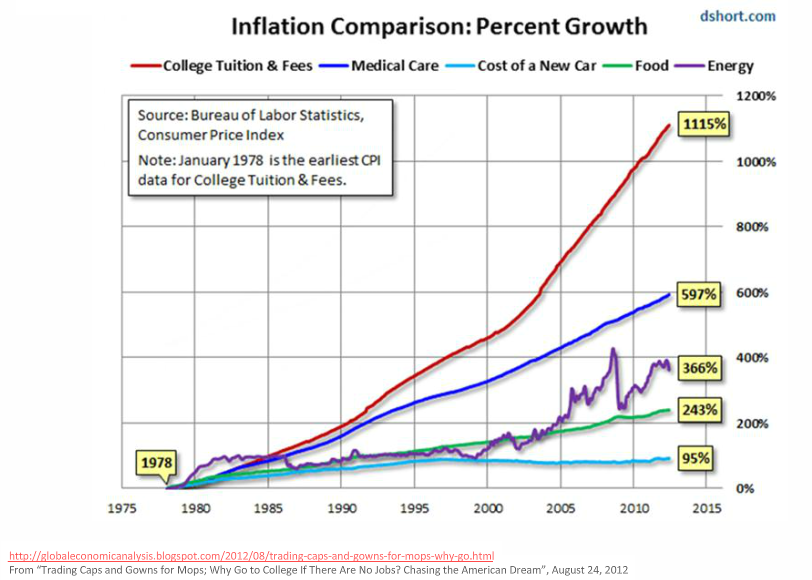

15. Not taking into account the effect of inflation

As you can see below, between 1940 and 1980, a portfolio composed of bonds would have lost around 70% in real term adjusted for inflation.

>> You should focus on your buying power and build a portfolio that will outperform inflation. Check out the BFM newsletter on inflation!

16. Buying what you don’t understand

>> Many losses could have been avoided if investors followed one, simple rule: always invest in what you know.

Specific mistakes made by expatriates

17. Failure to report investment income from assets held outside the United States

>> You may need to report your non U.S. based income on the IRS form 1040.

18. Failure to properly report foreign financial assets

FBAR penalties:

-A civil penalty of $10,000 for each non-willful violation

-If your violation is willful, the penalty is the greater of $100,000 or 50% of the amount in the account for each violation. Each year you didn’t file is a separate violation.

Criminal penalties:

-A fine of $250,000

-5 years of imprisonment

If the FBAR violation occurs while violating another tax law, the penalties are increased to $500,000 in fines and/or 10 years of imprisonment.

>> You may need to report your foreign accounts on the IRS form 8938 and on the Treasury Department form FIN Cen 114. More at http://tinyurl.com/Tax-Update-Francais-Etats-Unis.

19. Failure to understand FATCA and the impact of investing in a non-U.S. account (fees, taxes, tax reporting,…)

If you do not keep all your assets in the U.S. and if you invest in foreign mutual funds or ETF, they are considered PFIC and subject to very punitive U.S. taxation.

>> You may need to report your foreign ETF/Funds (like SICAV, French assurance vie...) on the IRS form 8621 and pay U.S. taxes (maybe 50%) even if you did not execute any trades and even if the value of your fund went down!

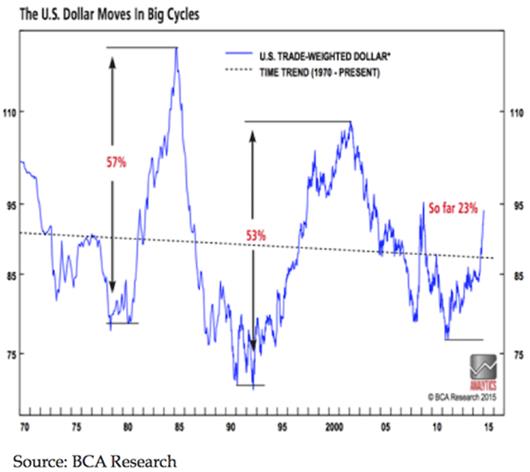

20. Failure to analyze your portfolio's true exposure to currency risk and its impact on your wealth

An hypothetical $1,000,000 accumulated savings in the U.S. during your career would have become 1,208,751 euros in 2000 (1 euro = $0.83) but you would have had only 627,431 euros (~50% less) if you moved back to France in 2008 (1 euro = $1.59)!

>> Check your current and future currency exposure and needs.

21. Failure to financially plan the move in or out of the U.S.

>> Contact your adviser to talk about strategies to minimize the tax impact on expatriates.

22. Failure to understand the link between un-excluded earned income and IRA contributions

>> To make a contribution to any type of IRA (traditional or Roth) you must have un-excluded earned income.

23. Failure to update your estate documents

>> You may need to have 2 wills (home country and another one for the U.S.) and create a U.S. trust to avoid probate.

24. Failure to work with a competent tax accountant and financial adviser

A 87-year-old lost 150% of the value of the foreign account after reporting it to the IRS as you can see at http://tinyurl.com/150pct-FBAR-Penalty. The OVDP (Offshore Voluntary Disclosure Program) is very costly for those who did not have the right information.

>> Your adviser should have the specialized expertise you need with a low retainer fee structure with no hidden fees.

>> Your adviser should have no proprietary products and no bosses on Wall Street, and he should seek to provide the best, unbiased strategies for your unique situation.

>> Financial planning may be more important than investments. Your adviser needs to give you more than just advice about stocks and bonds to help ensure a carefree retirement and peace of mind.

CONCLUSION

This fall, make sure the decisions you’ve made so far are the best ones to reach your financial goals.

If you are interested in charts and articles to improve your financial decisions, check out our daily postings at

www.tinyurl.com/BFM-Facebook

or our blog at

www.bourbonfm.com/blog.

What type of clients do we have? Our clients are located across the globe including North America, Europe and Asia. We have an unbiased approach in selecting our clientele i.e. our client base is broad encompassing expatriates, executives, entrepreneurs, working professionals, and business individuals. We welcome all clients from individuals with wealthy multi-million dollar portfolios to individuals who currently have negative net worth.

We have no portfolio size minimums.

Learn more about our straightforward flat fee conflict-free compensation model.

This newsletter was first published in September of 2016

https://us4.campaign-archive.com/?u=573d134676472fe56336c7f4f&id=504ff3ad16&e=f098147ae4